Subject Code & Title :- LA019399 Management Accounting

Assessment Type :- Assignment 1

What you have to do

This assessment consists of six (6) tasks. All tasks must be completed.

You must use the Excel template provided under Resources required for this assessment

LA019399 Management Accounting Assignment

Competency requirements

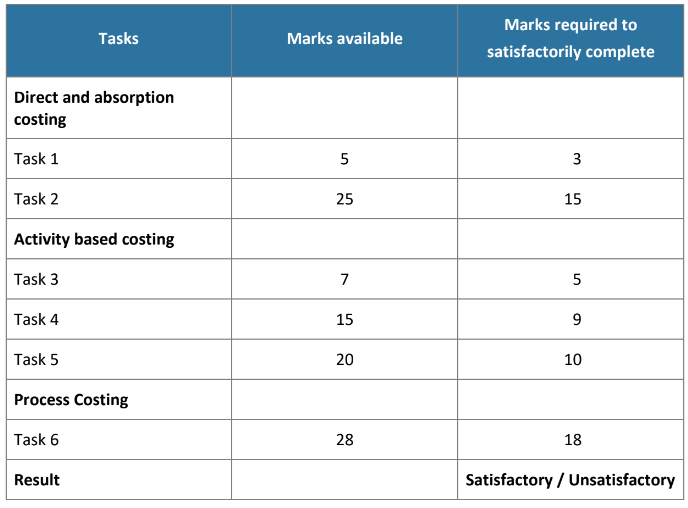

Students must achieve a satisfactory result in each task to pass this assessment.

If you do not satisfactorily complete any of the tasks (i.e. you do not achieve the nominated passing mark for that task then you will be required to do a gap assessment or a resubmit of the entire assessment. Please note you will not be able to attempt the assessment more than twice.

To achieve a satisfactory result in this assessment you must achieve (at least) the following results for each task:

Direct and absorption costing

Task 1

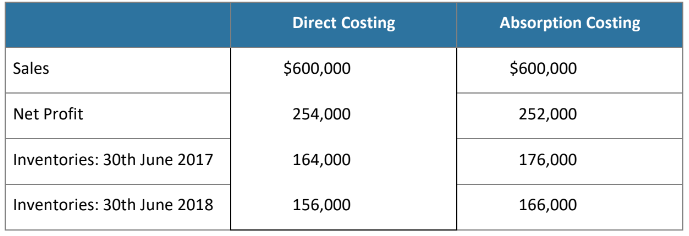

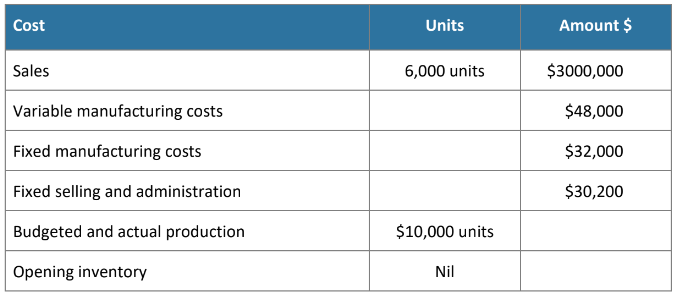

The following data relates to Dott Ltd for the year ended 30th June 2018:

Required:

Prepare a Reconciliation of the difference between the 2018 net profits under direct and absorption costing.

Task 2 :-

The Lake Side Company currently uses direct costing.The general manager has asked you to demonstrate the difference in profit or loss if they changed to absorption costing. The following information should be used.

The actual costs for July 2018 were:

Required:

a) Prepare an Income Statement (Profit and Loss Statement) using direct costing

b) Prepare an Income Statement (Profit and Loss Statement) using absorption costing

c) Prepare a reconciliation of the difference between the net profits under direct and absorption costing.

d) Using a Financial Software package such as MYOB or Xero produce an Income Statement (Profit and Loss Statement).

LA019399 Management Accounting Assignment

i. Provide evidence of this report, either by including a screen dump of the report or including a copy of the pdf version of the report.

ii. Name the Financial Software Package that you have used to produce the report.

iii. What is the Net Profit as shown on the Income Statement (Profit and Loss Statement)?

iv. Net Profit will be affected by whether management has chosen to use Direct Costing or Absorption Costing. Which of these methods would result in a higher net profit on the Income Statement (Profit and Loss Statement)?

Activity based costing

Task 3

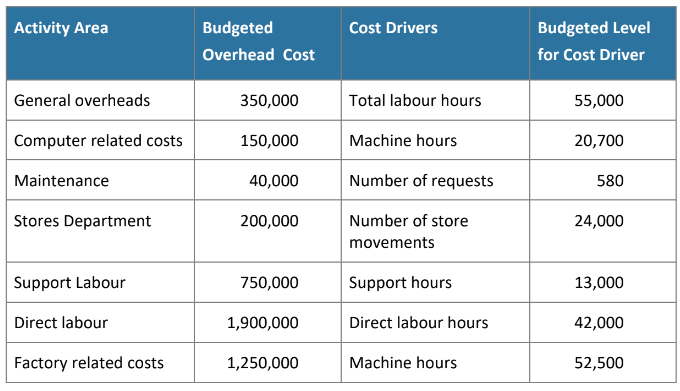

Calculate the application rate for each of the following activities using the cost drivers given (to two decimal places):

Task 4

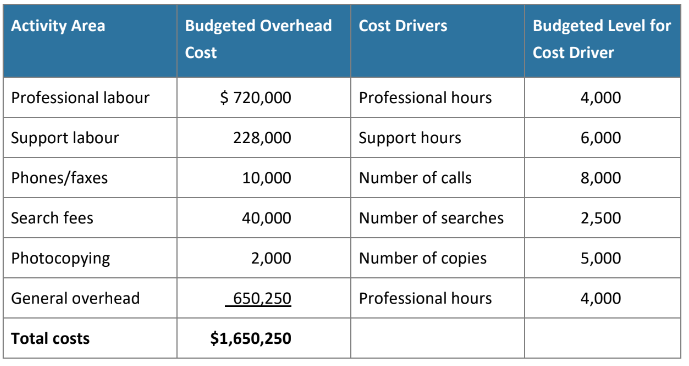

Black and White is a firm of tax advisors. You are provided with the following budget prepared using activity based costing principles:

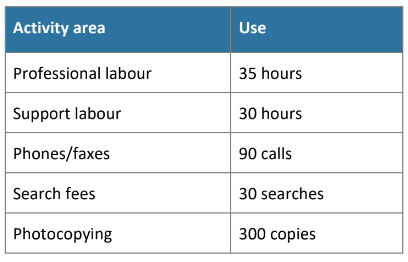

One client required the use of the following cost drivers:

Required:

a) Calculate the activity allocation rate to 2 decimal places

b) Calculate the total cost for the client.

c) If the firm requires a profit of 30% on cost, how much should be charged for this job?

Task 5

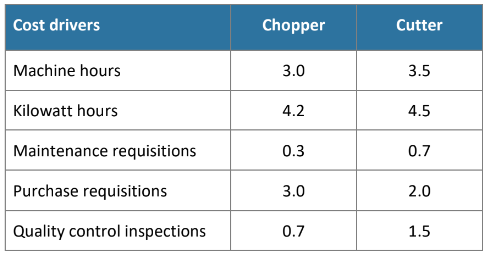

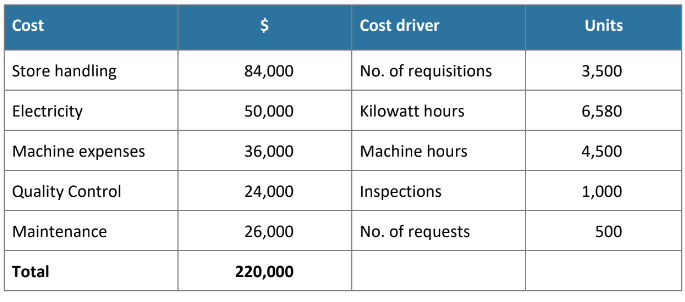

Maxx Ltd now produces two products, a premium Lawn Mower (the Chopper) and an economy version (the Cutter). The prime cost (i.e. direct materials and direct labour costs) are $380.00 for the Chopper and $300.00 for the Cutter.

To produce the Chopper, it requires 3 hours of direct labour; and only 2 hours to produce the Cutter. Factory overhead is allocated based on direct labour hours. The total budgeted factory overhead was $220,000 and direct labour hours were estimated at 8,000 hours.

The general manager has asked you to review the costing of these two products and compare the traditional method of costing with activity based costing. The details of the factory over head budget and the identified cost drivers are:

Budget:

Required:

a) Calculate the cost per unit for each product using the traditional cost allocation method.

b) Calculate the cost per unit for each product using activity based costing.

Process Costing :-

LA019399 Management Accounting Assignment

Task 6 :-

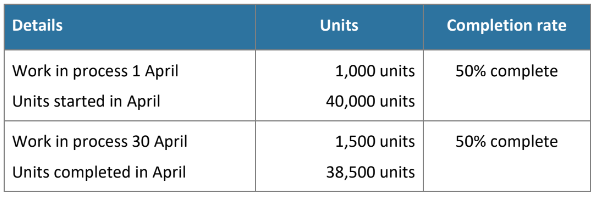

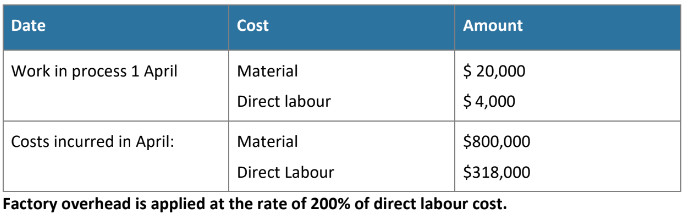

Smithe Ltd manufactures Brass Ashtrays and uses a process costing system. Only one product is produced in a single process. Polished Metal is input at the start of the process. Each unit produced is a 3 centimetre high Brass Ashtray.

Units emerging from the process are transferred immediately to finished goods. Conversion costs include labour and factory overheads are incurred uniformly throughout the process.

The goods are inspected at the end of the process before they are transferred to finished goods. Any Spoiled units are removed. Spoilage is usually 1% of good output and is added to the cost of good units leaving production. Abnormal Spoilage is not included in the cost of goods transferred to Finished Goods.

Production details for April are:

LA019399 Management Accounting Assignment

Costs details are:

Required:

a) Prepare a cost of production report (process cost summary report) for the month of April using weighted average inventory valuation showing:

i. The physical units

ii. The equivalent units and cost per equivalent units

iii. The value of work in process at 30 April

iv. The value of inventory transferred to finished goods during the month.

b) Show the work in process account for the month of April

ORDER This LA019399 Management Accounting Assignment NOW And Get Instant Discount

Read More :