Subject Code & Title :- LA023821 Management Accounting

Assessment Type :- Assignment 3

What you have to do

This assessment consists of six (6) tasks. All tasks must be completed.

You must use the Excel template provided under Resources required for this assessment.

LA023821 Management Accounting Assignment

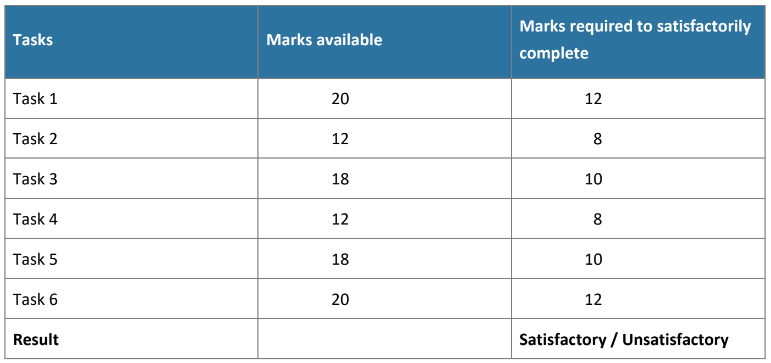

Competency requirements

Students must achieve a satisfactory result in each task to pass this assessment.

If you do not satisfactorily complete any of the tasks (i.e. you do not achieve the nominated passing mark for that task then you will be required to do a gap assessment or a resubmit of the entire assessment. Please note you will not be able to attempt the assessment more than twice. To achieve a satisfactory result in these topics you must achieve (at least) the following results for each task:

Task 1

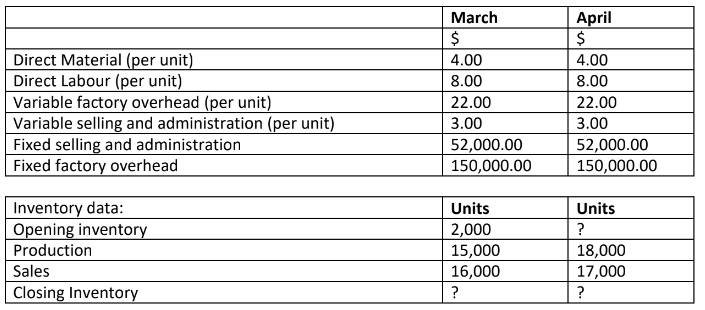

GB Enterprises use direct costing in accounting for its only product. However, for external reporting it must convert its financial reports to absorption costing. Its budgeted manufacturing over head rates are based on 180,000 units with fixed overhead costs being $1,800,000 and the variable cost per unit $20.

Factory overhead is applied using a predetermined overhead rate.

All other costs have remained constant in recent months; therefore opening stock is to be valued at the same cost per unit as closing inventory.

GB Enterprises actual results cost for March and April are as follows:

The selling price is $75.00 PER UNIT for each month

Under or over applied overhead is to be closed to cost of goods sold on a monthly basis. Required:

a) Income Statement for the month of April 2018 using Absorption costing

b) Income Statement for the month of April 2018 using direct costing

c) Reconcile the Net Profits derived under the two methods for the month

d) The direct costing method may be used for internal reporting only. Briefly describe ONE benefit or advantage from using direct costing for internal reporting

Task 2

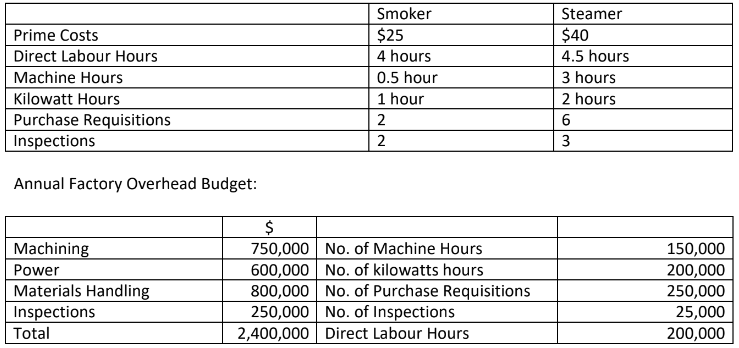

Choo Choo produces model trains. They have two models, the Smoker and the Steamer. Recently a new competitor Wales entered the market and has been selling a train similar to the Smoker at a cheaper price. Choo-Choo’s management accountant believes the traditional method of allocating factory overhead on the basis of direct labour hours could be a factor and has suggested changing to Activity Based Costing to add factory overhead to the cost of the products.

Choo-Choo has provided the following information for each of the products:

Required:

Calculate the cost per unit for both products using:

A) The traditional method of allocating factory overhead and

B) The activity based costing method

Task 3 :-

The Sea Saw Company commenced business on 1 November picking hens eggs for the overse as market.

Below are the details for the Department Number 3 where eggs in their jars, transferred in from Department Number 2, have vinegar and herbs added and are then transferred to Department Number 4, where lids and labels are added.

LA023821 Management Accounting Assignment

Production Details in Units – Department 3

Work in process November 1 Nil

Transferred In 156,000 units

Good units completed and transferred out 143,000 units

Work in process November 30 6,000 units

Percentage complete November 30 60%

Actual costs for November

Transferred In – Eggs in jars $399,360

Direct Material – Vinegar and herbs $89,232

Direct Labour $229,440

Factory Overhead $172,080

Additional Information:

• Eggs in jars are transferred into the start of Department Number 3 the vinegar and herbs are added 75% of the way through the process

• Overhead is applied at 75% of Direct Labour Cost

• Normal spoilage is 4% of good output. It is discovered at inspection at the end of the process in Department Number 3. The cost of normal spoilage is added to good units leaving production.

• Abnormal spoilage occurred at 50% of the way through the process when a production belt broke. Management requires abnormal spoilage to be charged to a special account.

Required

a) A cost of production report for Department Number 3 using FIFO clearly showing

(i) Equivalent units produced and the cost per equivalent unit to 2 decimal places for each item of material labour and overhead cost.

(ii) Total cost of transfers to Department Number 4

b) A Work in Process ledger Account for Department Number 3 (rounded to the whole dollar)

LA023821 Management Accounting Assignment

Question 4 :-

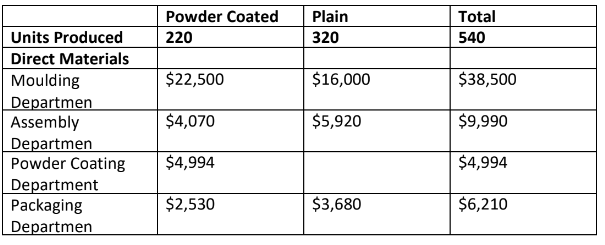

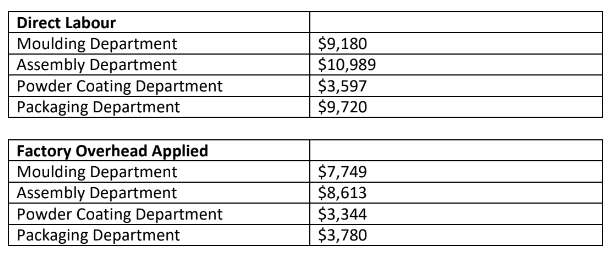

The Ride Away Company manufactures bicycle frames for mountain bikes using operation costing. Bicycle frames are manufactured in the moulding department.The frame parts are then transferred to the assembly department where they are partially assembled.

After assembly some are sent to be powder coated in a special paint then transferred to the packaging department. The Plain ones are sent straight to the packaging department. Plain bikes are sold at a mark up of 45% and the coated bikes are sold at a mark up of 75%.

Below are the quantities and direct material costs for January 2018.

Other processing costs for January 2018 are:

There is no beginning or ending work in process in any of the departments

Required:

a) Calculate the total cost of each bike and the cost per unit for January 2018.Your answer must show the total cost at the completion of each relevant department as well as the final cost per unit. Round costs to whole $).

b) Calculate the selling price per unit of both products.

c) Why is operation costing referred to as a hybrid system.

Task 5

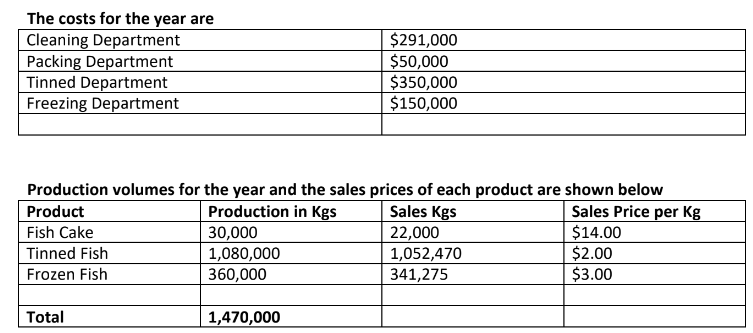

Fishy Business produces 3 products from its Fish:

• Fish Cakes

• Tinned Fish

• Frozen Fish

All fish are prepared in the Cleaning Department: all products emerge from this process. Fish Cake is then processed further in the Packaging Department. The tinned fish and frozen fish are further processed in the Tinned Department and the Freezing Department, respectively.

There are no inventory opening balances in any department.

Required

a) Calculate the unit cost to 4 decimal places for each product using the estimated net realisable value method

b) Calculate the value of closing inventory for all products.

c) What was the total amount of gross profit made from the sale of Fish Cake for the year?

Task 6 :-

CL Limited manufactures a single product employing a standard cost system to plan and control its production. The current standard material, labour and overhead cost to produce each unit is expected to be:

Direct Materials 16 parts @ $3.60 each $57.60

Direct Labour 3 hours @ $10.25 per hour $30.75

Factory Overhead 1.5 machines hours @ 12.00 per machine hour $18.00

————-

$106.35

Budgeted factory overhead per year $10,800

Budgeted fixed overhead per $8,865

Normal Operating Capacity 900 Machine hours

Actual production for the year is 500 units

Actual machines hours for the year: 880

hours

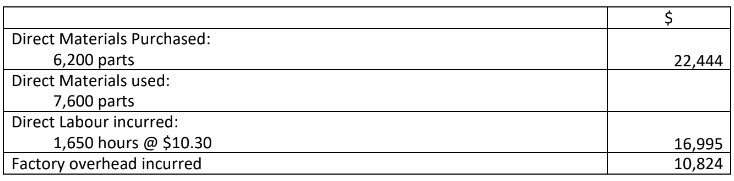

Actual costs for the business for the year are as follows:

• Materials price variance is calculated as early as possible

• There is no opening or closing work in

LA023821 Management Accounting Assignment

process Required:

A) Calculate Direct Material Price Variance

Direct Material Efficiency

Variance Labour Rate Variance

Labour Efficiency Variance

Overhead Spending

Variance Overhead

Efficiency Variance

Overhead Vlume Variance

(All workings must be shown and clearly labelled)

B) Write a brief explanation to factory management explaining what caused the Factory Overhead Volume Variance calculated above. Your explanation should NOT repeat the calculations involved.

ORDER This LA023821 Management Accounting Assignment NOW And Get Instant Discount

Read More :