Subject Code & Title :- EBFD411 Financial Planning

Assessment Type :- Assignment

CASE STUDY

Gavin and Sarah are married out of community of property with the accrual system They have two children Jonathan (25) and Emily (22). They also have two grandchildren Ethan (4) and Lily (2). Gavin is a CA and a Director at an investment company in Cape Town. He earns a salary of R1 500 000 per annum before tax. Gavin has not made any donations in the current year of assessment. Sarah is a shareholder at SunShine Pty Ltd. Her hours are flexible and she works on a project basis.

EBFD411 Financial Planning Assignment

They were married in February 1988. They have provided you with the following documents to assist with their estate planning:

1. A copy of Gavin’s will Accept that the will has been properly signed and wit nessed. Sarah could not find her will but has promised to send a copy to you later.

2. A copy of their ante nuptial contract (ANC) Accept that the ANC has been properly executed and witnessed.

3. A schedule drawn up by their previous advisor detailing the policies on their lives the owners there of and the beneficiaries where applicable.

Gavin and Sarah also provided you with the following information:

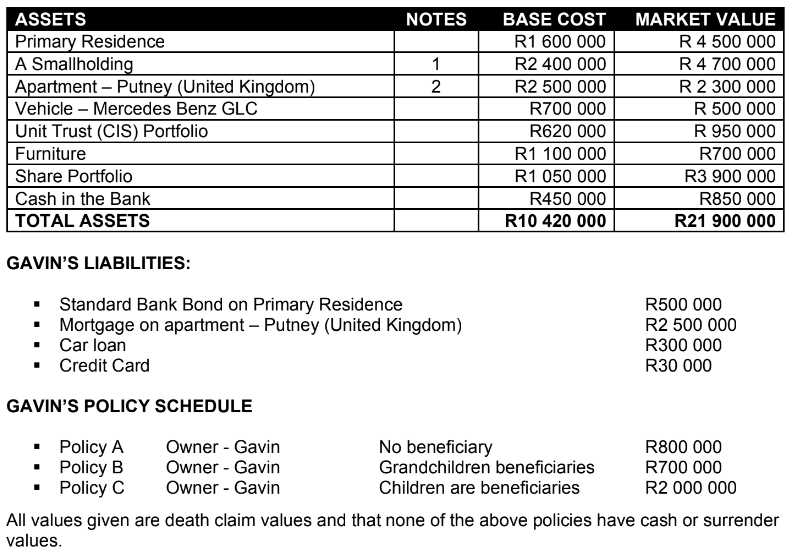

GAVIN’S ASSETS:

NOTES:

1.Gavin wishes to leave the small holding to his children or their descendants by representation.

2. Gavin in herited the overseas apartment in Putney UK from an aunt who is not a South African resident. She passed away in March 2007.

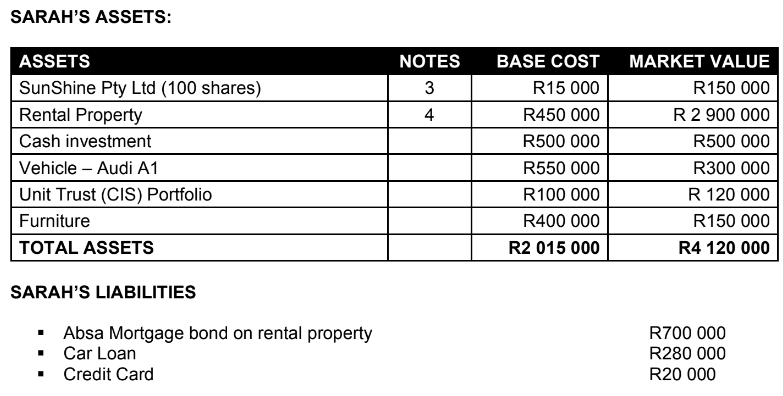

3.She received the shares as part of a share incentive scheme The base cost is as it was on 31 October 2001.

4.She bought the property with money inherited from her father who passed away in 2003.

5.The mortgage bond is for renovations that she recently made to the property and is being settled solely from the rental income generated by the property. The monthly rental is R12 000 and she pays R7 500 per month towards the mortgage bond registered over the property.

6.You can accept that the CPI in February 1988 was 12.8 and present is 109.2

LAST WILL AND TESTAMENT OF GAVIN SAMUELS

▪ I Gavin Samuels married out of community of property to Sarah Samuels Nee Jappie here in after called my spouse hereby revoke all Wills and Codicils previously made by me and declare this to be my last will and testament.

▪ I bequeath my primary residence to my son Jonathan or his descendants by representation.

▪ I bequeath my share portfolio to my daughter Emily or her descendants by representation.

▪ I bequeath the remainder of my estate to the trustees, in their representative capacity of the

Gavin Samuels Family Trust. The inheritance is to be added to the trust and administered by them in accordance with the provisions of the trust.

And the appearers declared that whereas a marriage has been agreed and is intended to be solemnised between them they have agreed and contract with each other as follows:

1 That there shall be no community of property between them.

2 There shall be no community of profit and loss between them.

3 That the marriage shall be subject to the accrual system in terms of the provisions of Chapter 1 of the Matrimonial Property Act,88 of 1984.

4 That the intended spouses declared that the nett value of their respective estates at the commencement of the intended marriage to be as follows:

a) The estate of Sarah Jappie to be R30 000 thirty thousand Rand consisting of movable assets and investments and

b) The estate of Gavin Samuels to be R120 000 one hundred and twenty thousand rand consisting of movable assets and investments.

5 That the assets of the parties which are listed hereunder, having the values shown shall not be taken into account as part of such party’s estate at either the commencement or the dissolution of the marriage:

a) The assets of Sarah Jappie so to be excluded are: 100 shares in SunShine Pty Ltd and

b) The assets of Gavin Samuels so to be excluded are: none

Thus done and signed at Cape Town on the day month and year aforewritten in the presence of the under signed witnesses.

EBFD411 Financial Planning Assignment

QUESTION ONE :-

1.1 Assume that Gavin passes away first (today). Calculate the accrual claim.

1.2 Calculate how much capital gains tax will be due in the event of him passing away.

1.3 Calculate the estate duty payable by Gavin’s estate (if any). (Assume that the admin costs in the estate is R20 000,funeral costs are R120 000 and Masters Fees are R7000).

1.4 Assume that Gavin has a liquidity shortfall of R9 000 000 in his e state. Suggest four ways in which he can address the problem and explain to him why you suggest this and how your suggestion will impact his estate duty and or other expenses in his estate. Calculation not required.

QUESTION TWO :-

On advice from his previous advisor, Gavin is considering selling the small holding to the Gavin Samuels Family Trust. The trust is in the process of being formed. He was advised that the transfer of the small holding would reduce his estate duty liability.

The sale of the small holding is intended to be at its full market value. As the trust is newly formed Gavin intends to provide the trust with a loan for the purchase price. The loan will attract interest at a rate of 4% per annum. Accept that the official rate of interest is 8% per annum.

2.1 Gavin is surprised when you tell him that selling the small holding to the trust will result in a substantial tax liability for him when he does so. Explain to Gavin what taxes and how much tax will be payable as a result of the sale. Show basic calculations to illustrate your point.

2.2 With reference to specific legislation explain to Gavin the annual tax liability that will arise as a result of the proposed sale and calculate the amount payable annually.

2.3 Other than to save future estate duty, provide Gavin with two reasons why a trust can be useful to them in their estate planning.

QUESTION THREE :-

Gavin’s unit trust portfolio is currently invested in the Ninety One Managed Fund. Gavin wonders whether this portfolio is appropriate for him to be invested in. He is looking for an aggressive growth portfolio.

3.1 Attach a copy of the latest Fund Fact Sheet for this portfolio to your assignment submission.

3.2 Explain to Gavin what the objective is and what the returns of the Ninety One Managed Fund have been and comment on whether this portfolio suits the aggressive growth that he is looking for.

3.3 Identify the average annual return earned by this portfolio for the past 1 and 3 years.

ORDER This EBFD411 Financial Planning Assignment NOW And Get Instant Discount

Read More :