Subject Code and Title :- ACC601: Introduction to Financial Accounting

Assessment :- Assessment 1 – Reflection report

Individual/Group :- Individual

Length :- 1500 words (+/- 10%)

Weighting :- 20%

ACC601 Introduction To Financial Accounting Assignment

Learning Outcomes :-

The Subject Learning Outcomes demonstrated by successful completion of the task below include:

a) Articulate and implement regulatory and ethical frame works and the use of accounting information to support business decision making.

b) Apply the accounting cycle and double entry accounting principles to process transactions.

Assessment Task :-

There are two parts to this assessment. Firstly Part A requires you to write a business letter with suggestions on how to address the ethical issues discussed in a case scenario. Secondly Part B requires you to process accounting transactions using Xero (cloud-based accounting software and prepare a reflection report discussing your experience and knowledge gained from this task.

Context :-

Professional Accountants are expected to uphold high ethical standards and are often subject to scrutiny by the senior managers employees clients and other members of the community. Part A of this assessment will enable you to under stand the ethical principles that accountants must follow the ethical threats they experience at work and how to deal with those ethical challenges.

It is important that accounting professionals know how to manage business accounts and generate financial reports using computerised accounting systems. Part B of this assessment will provide you with hands on experience in areas such as entering invoices and bills receiving and making payments and processing journals in Xero via the plug in educational platform Accounting Pod. The Accounting Pod platform provides you with access to learning resources and step by step instructions for practicing how to record business transactions in Xero. After completing the practice set module of Accounting Pod you will consider fundamental accounting concepts and their relationship to computerised accounting systems by reflecting upon learnings experiences and challenges faced while completing the practice set.

Instructions :-

Part A – Ethics Case Scenario

Torrens University Australia has introduced a project that gives students the opportunity to gain work experience as an intern in a public accounting firm. As a participant in this project you had an opportunity to work at JM Accounting a public accounting firm for a month. During the internship period you received training from several employees of JM Accounting. In particular you had opportunities to work closely with two individuals John Roberts and Peter Clare. John works as a trainee accountant and Peter is John’s manager who works as a senior accountant.

John is now in his first year of training within the firm. A more senior trainee has been on sick leave and John is due to go on study leave. John has been told by Peter that he must complete some complicated reconciliation tasks before he goes on leave. The deadline suggested by Peter appears unrealistic given the complexity of the tasks.

John feels that he is not sufficiently experienced to complete the work alone. He would need additional supervision to complete it to the required standard and Peter appears unable to offer the necessary support. If John tries to complete the work within the proposed timeframe but fails to meet the expected quality he could face repercussions on his return from study leave. He feels slightly intimidated by Peter and also feels pressure to do what he can for the practice that is now going through challenging times. John is facing ethical dilemmas about what he should do.

Required

Write a business letter in your own words, addressed to John Roberts explaining:

1.the ethical principles that will be affected if he performs the reconciliation tasks, and

2.possible courses of action that he can take in this situation.

Notes

Your explanation must refer to the appropriate principles from the APES 110 Code of Ethics for Professional Accountants. Generic answers will achieve minimal marks.

Your letter must meet the following formatting requirements:

• Date your letter the 12th April 2022

• Address your letter to John Roberts JM Accounting 884 Stanley St, East Brisbane QLD 4169 Australia.

• Any formal business letter format is acceptable (a template has not been provided students are expected to research business letter formats themselves.

• Consider an appropriate way to sign off your letter

• Set out your letter with subheadings to separate each part of your letter as you address the criteria required

• No specific word count is prescribed. However, given the nature of the questions, it would be expected that the entire letter including address and sign-off) should require no more than 600 words.

Part B – Reflection Report

Please follow the instructions below to complete this assessment.

Register an account with AccountingPod. Access to AccountingPod will be granted via email invitation to each student’s Torrens email address from the Accounting Pod team.

Complete the practice set by following the instructions provided by AccountingPod. Note: Accounting Pod will offer you immediate task feedback (i.e., one piece of feedback per Xero technical task) and interactive technical support via its educational platform (during business days and within 24 hours response time

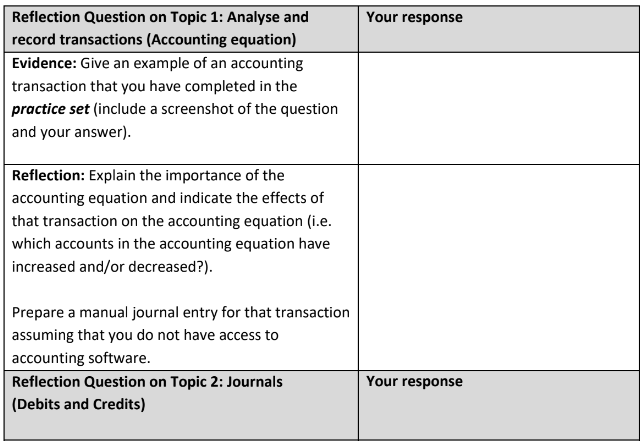

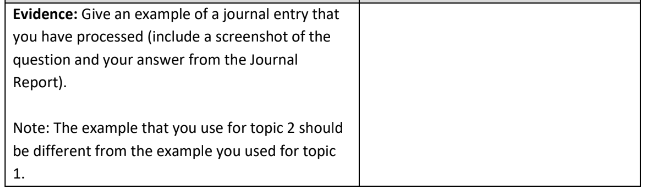

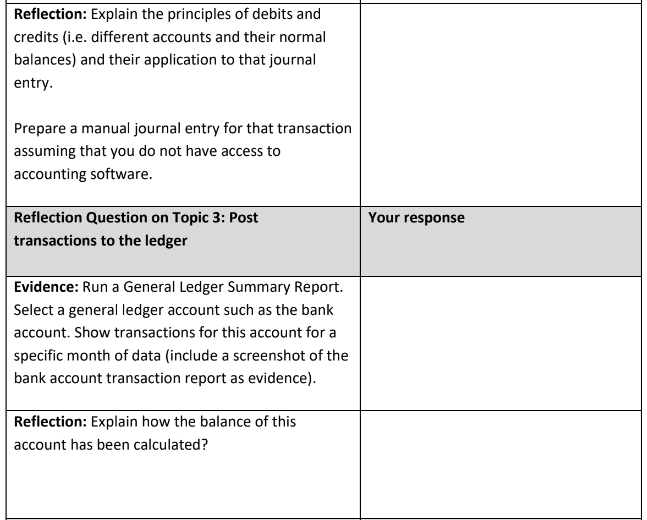

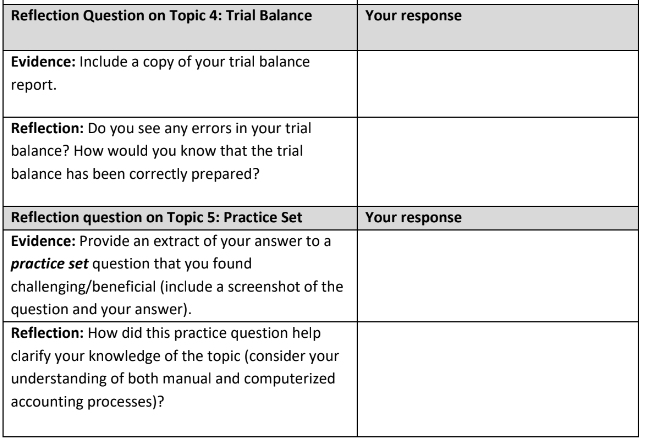

Prepare a reflection report answering the following questions on 5 topic areas Each topic listed in the template below requires evidence to support your reflection such as including a screenshot with an example of a specific practice set question relating to that topic.

ORDER This ACC601 Introduction To Financial Accounting NOW And Get Instant Discount

Read More :